Disclaimer: This post may contain affiliate links, meaning we get a small commission if you make a purchase through our link at no extra cost to you. For more information, please visit our Disclaimer Page.

Just think about how you’d feel if your car broke down, your roof sprang a leak, or an exciting opportunity arose—and you had $10,000 ready to handle it. Sounds nice, doesn’t it?

A $10,000 savings fund isn’t just a random goal—it’s a life-changing financial milestone that can transform your relationship with money.

According to a 2023 Bankrate survey, nearly 57 per cent of Americans couldn’t cover a $1,000 emergency expense from savings.

The $10K challenge aims to change that statistic, one saver at a time.

If you want to build an emergency fund, save for a down payment, or just feel more financially secure, the $10K savings challenge offers a structured path to success.

In this guide, we’ll explore different timeframes—from the steady 52-week approach to the intense 100-day sprint—so you can choose the plan that fits your life and financial situation.

Ready to transform your financial future? Let’s dive in.

Setting Your Savings Foundation

Finding Your “Why”

Before you start stashing away cash, take a moment to clarify exactly why you’re saving $10,000. Your “why” will be the fuel that keeps you going when motivation wanes.

Common reasons for a $10,000 fund include:

- Creating a robust emergency fund (financial experts typically recommend 3–6 months of expenses)

- Saving for a down payment on a home

- Building a fund for a major life change (career switch, moving to a new city)

- Creating capital for investments or starting a business

- Planning for a dream vacation or wedding

Whatever your reason, write it down and keep it visible.

Research from the Dominican University of California shows that people who write down their goals are 42 per cent more likely to achieve them.

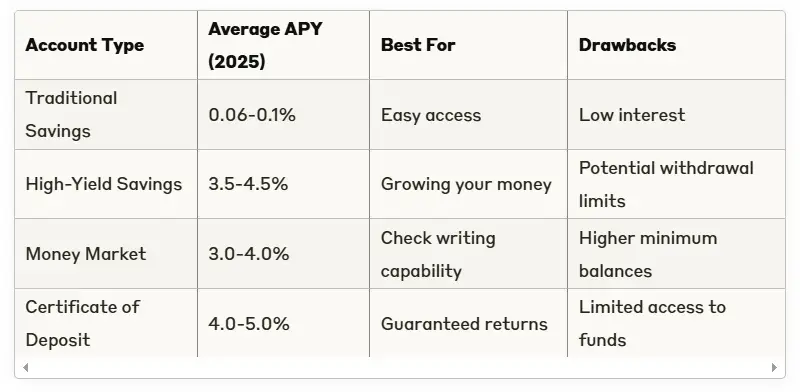

Choosing the Right Account

Not all savings accounts are created equal. Here’s a quick comparison:

Choosing the Right Savings Account

For most savers, a high-yield savings account offers the best balance of growth, safety, and accessibility.

Look for accounts with no monthly fees, low minimum balances, and FDIC insurance (up to $250,000 per depositor).

10k Savings Challenge Breakdown

52-Week Savings Challenge

The 52-week challenge breaks your $10,000 goal into manageable weekly deposits over one year. Here’s how it works:

If you’re aiming to save $10,000 in 52 weeks, consistency is key! By saving a manageable amount each week, you’ll reach your goal while sticking to your budget.

Savings Breakdown

| Frequency | Amount to Save | Notes |

|---|---|---|

| Daily | $27.40 | Requires daily discipline. |

| Weekly | $192.31 | Ideal for weekly income earners. |

| Bi-weekly | $384.62 | Matches most payroll schedules. |

| Monthly | $833.33 | Best for structured budgeters. |

Pro Tip:

Cut unnecessary expenses and prioritize saving first. Automate your savings to make it effortless.

This approach works well for most people because it aligns with regular pay periods and avoids drastic lifestyle changes.

Bi-Weekly Savings Challenge

Syncing with your pay schedule is a great way to make saving easier—here’s the breakdown:

| Frequency | Amount to Save | Notes |

|---|---|---|

| Bi-weekly | $384.62 | 26 deposits over 52 weeks, synced with paydays. |

| Monthly | $833.33 | Equivalent to bi-weekly savings over a month. |

Pro Tip: Set up automatic transfers on paydays to ensure consistency. Stick to your plan, and you’ll hit your target!

Finding Extra Money to Save

To make the six-month timeline work, you’ll need to find additional savings or income. Consider:

- Taking on a side hustle (the average side gig brings in $1,122 monthly)

- Selling unused items

- Temporary lifestyle adjustments (pausing subscriptions, reducing dining out)

- Applying windfalls like tax refunds or work bonuses

$10,000 Savings Challenge in 6 Months

If you’re aiming to save $10,000 in six months, consistency and commitment are key. Break the goal into manageable amounts to stay on track:

Savings Breakdown

| Frequency | Amount to Save | Notes |

|---|---|---|

| Daily | $54.95 | Requires disciplined daily saving. |

| Weekly | $384.65 | Ideal for weekly income earners. |

| Bi-weekly | $769.30 | Matches most payroll schedules. |

| Monthly | $1,666.67 | Best for structured budgeters. |

Pro Tip: Cut unnecessary expenses, prioritize saving first, and automate transfers to make it effortless.

$10,000 Savings Challenge in 3 Months

To reach $10,000 in three months, focus and consistency are essential. Use this structured plan:

Savings Breakdown

| Frequency | Amount to Save | Notes |

|---|---|---|

| Daily | $111.11 | Requires disciplined daily saving. |

| Weekly | $769.23 | Ideal for weekly income earners. |

| Bi-weekly | $1,666.67 | Matches most payroll schedules. |

| Monthly | $3,333.33 | Best for structured budgeters. |

Pro Tip: Automate savings to maintain momentum and avoid overspending.

$10,000 Savings Challenge in 100 Days

If you’re aiming to save $10,000 in 100 days, dedication is key—but breaking the goal into smaller increments will keep you motivated.

Savings Breakdown

| Frequency | Amount to Save | Notes |

|---|---|---|

| Daily | $100.00 | Requires focused daily discipline. |

| Weekly | $700.00 | Ideal for weekly income earners. |

| Bi-weekly | $1,400.00 | Matches most payroll schedules. |

| Monthly | $3,030.30 | Best for monthly flexibility. |

$10,000 Savings Challenge – 2 Years

For a long-term approach, this plan breaks $10,000 into manageable amounts over 730 days (two years).

Savings Breakdown

| Frequency | Amount to Save | Notes |

|---|---|---|

| Daily | $13.70 | Requires consistent daily saving. |

| Weekly | $96.15 | Ideal for weekly income earners. |

| Bi-weekly | $192.31 | Matches payroll schedules. |

| Monthly | $416.67 | Best for structured budgeting. |

Pro Tip:

Automate daily deposits to make the 100-day challenge manageable. Consistent habits prevent overwhelm—stick to the plan, and progress accelerates!

Maximizing Three-Paycheck Months

Bi-weekly earners receive three paychecks in two months annually. Use these “bonus” months to:

- Catch up if behind.

- Accelerate savings progress.

Mark these months on your calendar and allocate extra funds strategically.

$10,000 Savings Challenge Printables

Visualize progress with free printable trackers from trusted financial resources.

Digital Tools to Keep You on Track

Beyond printables, leverage these digital tools to streamline your savings:

- YNAB (You Need A Budget) for comprehensive budgeting.

- Qapital for rule-based automatic saving.

- Mint to track all accounts in one place.

- Digit for automated saving based on spending patterns.

Overcoming Common Obstacles

When Life Happens

Even the best plans face challenges. Here’s how to adapt:

Dealing with Unexpected Expenses

If an emergency forces you to dip into savings:

- Stay calm—this is why you saved!

- Withdraw only what’s necessary.

- Adjust your timeline if needed.

- Resume your plan promptly.

Staying Motivated

Combat motivation dips with these strategies:

- Track progress visually (e.g., charts or apps).

- Celebrate milestones (e.g., every $1,000 saved).

- Share goals with an accountability partner.

- Revisit your “why” regularly.

- Join online savings communities (e.g., r/personalfinance).

What to Do if You Fall Behind

If you miss a deposit:

- Diagnose the cause.

- Use windfalls (bonuses, tax refunds) to catch up.

- Adjust your timeline if necessary.

- Focus on progress over perfection.

What to Do After Reaching $10,000

Celebrating Your Achievement

Reaching $10,000 is a major milestone—celebrate responsibly:

- Take a photo with your savings tracker.

- Share success with your accountability partner.

- Document lessons for future goals.

- Reward yourself modestly (e.g., a special meal).

Smart Next Steps

Choose your path based on financial priorities:

- Emergency fund: Ensure it covers 3–6 months of expenses. If not, set a new target.

- Debt-free with savings: Explore investments like a Roth IRA or brokerage account.

- High-interest debt: Allocate savings to reduce debt while keeping a smaller emergency fund.

- Specific goals: Advance to the next milestone or transition to execution (e.g., home purchase).

Setting Your Next Financial Goal

Success breeds success. Consider these next steps:

- Increase your emergency fund to cover 6–12 months of expenses.

- Start a retirement savings challenge.

- Begin saving for a home down payment.

- Create an investment fund.

- Build a business startup fund.

Tracking Your Progress to $10,000

Success with the 100-day challenge hinges on consistent tracking. Consider:

- Using a dedicated app like Qapital or Digit.

- Creating a visual tracker (download our free printable).

- Setting daily phone reminders.

- Keeping a money journal to reflect on progress.

The 7 Best Ways to Save $10,000

- Set a Goal: Break $10,000 into weekly/monthly targets.

- Automate Savings: Schedule automatic transfers.

- Track Spending: Use apps like Mint or YNAB to cut expenses.

- Boost Income: Start a side gig or sell unused items.

- Pay Off High-Interest Debt: Free up cash by eliminating credit card debt.

- Cut Non-Essentials: Limit impulse buys with a no-spend challenge.

- Stay Consistent: Track progress and celebrate milestones.

Wrapping Up: The $10,000 Savings Challenge

The $10,000 savings challenge isn’t just about money—it’s about building lifelong financial habits. Whether you choose the 52-week approach, the 100-day sprint, or another plan, start today.

Remember:

- Choose a timeframe that fits your income and lifestyle.

- Automate savings for consistency.

- Track progress to stay motivated.

- Stay flexible when life interrupts.

- Celebrate all wins, big or small.

Ready to transform your financial future?

Download free resources and begin your $10,000 challenge today!

Share your plan: Comment below with your chosen timeframe and strategy!