Disclaimer: This post may contain affiliate links, meaning we get a small commission if you make a purchase through our link at no extra cost to you. For more information, please visit our Disclaimer Page.

Feeling financially stressed?

You’re not alone.

Transforming your finances doesn’t require a massive overhaul – it’s about adopting smart habits and consistent strategies.

These “financial life hacks” make managing your money easier and more rewarding.

In this guide, we’ll explore ten powerful hacks to supercharge your finances and build a secure future!

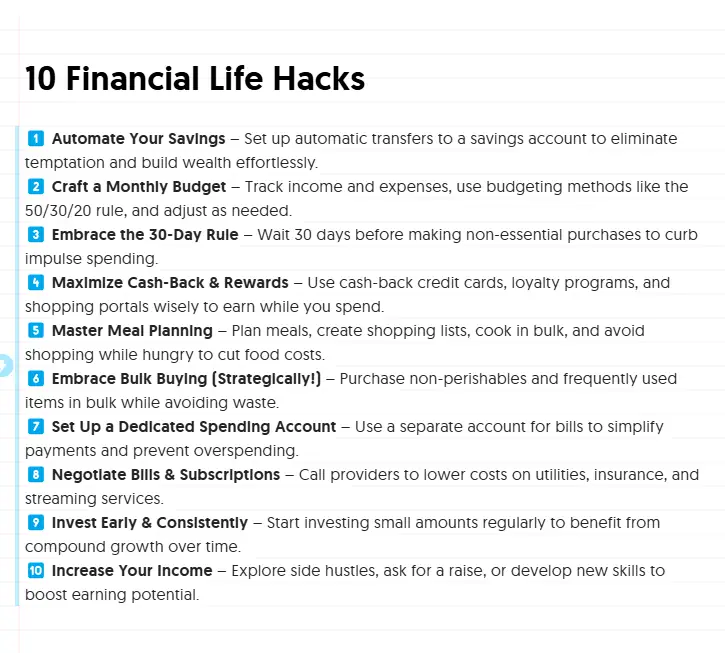

Here are the 10 Financial Life Hacks

1. Automate Your Savings: The “Set It and Forget It” Approach to Wealth Building

Saving money is often seen as a chore, a constant battle against temptation and immediate gratification.

But what if you could remove the willpower element and make saving automatic? That’s the beauty of automating your savings.

Why Automate?

- Removes Temptation: By automatically transferring money to your savings account before you even see it, you eliminate the temptation to spend it.

- Consistency is Key: Small, consistent savings add up over time. Automating ensures that you’re consistently setting aside money, even when life gets busy.

- Psychological Boost: Knowing that you’re consistently saving, even if it’s a small amount, provides a psychological boost and reinforces positive financial habits.

How to Automate Your Savings:

- Open a Dedicated Savings Account: If you don’t already have one, open a separate savings account specifically for your savings goals. Consider a high-yield savings account (HYSA) at an online bank to maximize your earnings.

- Determine Your Savings Goal: Start by setting a realistic savings goal, even if it’s just $50 or $100 per month. You can always increase it later as you become more comfortable.

- Set Up Automatic Transfers: Most banks allow you to set up automatic transfers from your checking account to your savings account. Schedule these transfers to occur on payday or shortly after you receive your income.

- Treat it Like a Bill: Consider your savings contribution as a non-negotiable bill that you must pay each month. This mindset will help you prioritize saving and avoid dipping into your savings account for unnecessary expenses.

- Review and Adjust: Regularly review your savings progress and adjust your automatic transfer amount as needed. As your income increases or your expenses decrease, consider increasing your savings contribution to accelerate your progress.

Pro-Tip: Explore apps like Digit or Acorns that automatically save small amounts of money by rounding up your purchases or transferring spare change to your savings account.

2. Craft a Monthly Budget: Your Roadmap to Financial Freedom

A budget is simply a plan for how you’re going to spend your money.

It’s a powerful tool that allows you to take control of your finances, track your spending, and identify areas where you can save more.

Why Budget?

- Gain Control: A budget gives you a clear picture of where your money is going, allowing you to make informed decisions about your spending.

- Identify Leaks: By tracking your expenses, you can identify areas where you’re overspending or wasting money on unnecessary items.

- Achieve Financial Goals: A budget helps you allocate funds towards your financial goals, such as paying off debt, saving for a down payment on a house, or investing for retirement.

- Reduce Stress: Knowing where your money is going and having a plan for the future can reduce financial stress and improve your overall well-being.

How to Create a Monthly Budget:

- Calculate Your Income: Start by calculating your total monthly income after taxes.

- Track Your Expenses: Track your expenses for at least a month to get a clear picture of where your money is going. Use a budgeting app, spreadsheet, or notebook to record your expenses.

- Categorize Your Expenses: Categorize your expenses into fixed expenses (e.g., rent, mortgage, car payments) and variable expenses (e.g., groceries, entertainment, dining out).

- Allocate Funds: Allocate funds to each category based on your income and financial goals.

- Review and Adjust: Regularly review your budget and adjust it as needed. Life changes, and your budget should reflect those changes.

Budgeting Methods:

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budget: Allocate every dollar of your income to a specific category, ensuring that your income minus your expenses equals zero.

- Envelope System: Use cash for variable expenses, such as groceries and entertainment, and allocate a specific amount of cash to each envelope each month.

Pro-Tip: Explore budgeting apps like Mint, YNAB (You Need a Budget), or Empower to automate the budgeting process and track your spending in real-time.

3. Embrace the 30-Day Rule: Taming the Impulse Buy Beast

Impulse buying can sabotage even the best-laid financial plans.

The 30-day rule is a simple but powerful technique to combat impulse buying and ensure that you’re only buying things you truly need and want.

How the 30-Day Rule Works:

Before making any non-essential purchase (anything that isn’t a necessity like rent, food, or transportation), wait 30 days.

During this time, consider whether you truly need the item, whether you can afford it, and whether it aligns with your financial goals.

Why the 30-Day Rule Works:

- Cooling-Off Period: The 30-day waiting period allows you to cool off from the initial excitement of wanting the item.

- Needs vs. Wants: It forces you to differentiate between needs and wants. Often, what seems like a must-have in the heat of the moment turns out to be something you can easily live without.

- Financial Awareness: It makes you more aware of your spending habits and helps you make more conscious purchasing decisions.

- Opportunity Cost: It reminds you of the opportunity cost of your purchases. That money could be used for more important financial goals, such as paying off debt or investing.

Pro-Tip: Create a “wish list” where you can record items that you want to buy.

After the 30-day waiting period, revisit your wish list and see if you still want the items.

You may be surprised at how many items you no longer desire.

4. Maximize Cash-Back and Rewards Programs: Turning Spending into Savings

Why leave money on the table when you can earn rewards and cash back on your everyday spending?

Cash-back credit cards and rewards programs can be a great way to offset expenses and boost your savings.

How to Maximize Rewards:

- Choose the Right Card: Research and choose a cash-back or rewards credit card that aligns with your spending habits. Some cards offer higher rewards on specific categories, such as groceries, gas, or travel.

- Pay Your Balance in Full: Always pay your credit card balance in full each month to avoid interest charges, which can negate the benefits of the rewards program.

- Sign Up for Loyalty Programs: Sign up for loyalty programs at stores you frequent to earn points or discounts on your purchases.

- Use Cash-Back Portals: Use cash-back portals like Rakuten or Honey when shopping online to earn cash back on your purchases.

- Redeem Rewards Wisely: Redeem your rewards strategically, whether it’s for cash back, statement credits, travel, or gift cards.

Pro-Tip: Be mindful of annual fees and spending requirements when choosing a rewards credit card.

Make sure the rewards outweigh any fees or minimum spending requirements.

5. Master Meal Planning: The Secret Ingredient to a Frugal Kitchen

Food is a significant expense for most households. Meal planning can help you save money, eat healthier, and reduce food waste.

How to Meal Plan Like a Pro:

- Plan Your Meals for the Week: Take some time each week to plan your meals for the week, considering your schedule, dietary needs, and budget.

- Create a Shopping List: Create a detailed shopping list based on your meal plan and stick to it when you go to the grocery store.

- Cook in Bulk: Cook larger portions of meals and freeze leftovers for future meals.

- Eat Before You Shop: Avoid shopping when you’re hungry, as this can lead to impulse purchases.

- Pack Your Lunch: Pack your lunch instead of eating out, which can save you a significant amount of money over time.

Pro-Tip: Explore websites and apps that offer meal planning templates, recipes, and grocery lists to make the process easier and more efficient.

6. Embrace Bulk Buying (Strategically!): When More is Actually Less

Buying in bulk can save you money on certain items, but it’s important to do it strategically to avoid waste and overspending.

When to Buy in Bulk:

- Non-Perishable Items: Stock up on non-perishable items that you use frequently, such as toilet paper, paper towels, cleaning supplies, and pantry staples.

- Items You Use Regularly: Buy in bulk on items that you use regularly and know you’ll consume before they expire.

- When There’s a Sale: Take advantage of sales and discounts to buy items in bulk at a lower price.

When to Avoid Buying in Bulk:

- Perishable Items: Avoid buying perishable items in bulk unless you can consume them before they spoil.

- Items You’re Unsure About: Don’t buy items in bulk if you’re unsure whether you’ll like them or use them regularly.

- When You Don’t Have Storage Space: Make sure you have adequate storage space before buying items in bulk.

Pro-Tip: Consider splitting bulk purchases with friends or family to share the savings and reduce waste.

7. Set Up a Dedicated Spending Account: A Financial Firewall for Bills

Simplify bill payments and reduce the risk of late fees by setting up a dedicated spending account for recurring expenses.

How to Set Up a Spending Account:

- Open a Separate Checking Account: Open a separate checking account specifically for paying bills. Digital-only banks can be a good option.

- Estimate Monthly Expenses: Calculate your total monthly recurring expenses, such as rent, utilities, subscriptions, and loan payments.

- Automate Deposits: Set up automatic transfers from your primary checking account to your spending account to cover your monthly expenses.

- Pay Bills Automatically: Set up automatic bill payments from your spending account to ensure that your bills are paid on time.

Pro-Tip: Choose a spending account that offers free checking and online bill pay.

8. Negotiate Everything: Sharpen Your Bargaining Skills

Don’t accept the sticker price!

Negotiation is a powerful tool for saving money on a wide range of expenses.

What to Negotiate:

- Bills: Negotiate your internet, cable, and phone bills with your service providers.

- Insurance: Shop around for better insurance rates and don’t be afraid to negotiate your premiums.

- Purchases: Negotiate the price of big-ticket items like cars, appliances, and furniture.

- Rent: If you’re a good tenant, negotiate your rent renewal with your landlord.

Negotiation Tips:

- Do Your Research: Know the market value of the item or service you’re negotiating for.

- Be Polite and Respectful: Building rapport can go a long way in getting a better deal.

- Be Willing to Walk Away: Knowing your bottom line and being willing to walk away gives you leverage.

- Ask for Discounts: Don’t be afraid to ask for discounts, such as senior discounts, student discounts, or military discounts.

Pro-Tip: Practice your negotiation skills in low-stakes situations to build your confidence.

9. Invest in Energy-Efficient Solutions: Saving Money While Saving the Planet

Energy-efficient solutions can help you lower your utility bills and reduce your carbon footprint.

Energy-Saving Tips:

- Switch to LED Bulbs: LED bulbs use significantly less energy than traditional incandescent bulbs and last much longer.

- Use a Programmable Thermostat: A programmable thermostat can automatically adjust your home’s temperature based on your schedule, saving you energy and money.

- Seal Drafts and Insulate: Seal drafts around windows and doors and add insulation to your attic and walls to prevent heat loss.

- Unplug Electronics: Unplug electronics when they’re not in use, as they can still draw power even when turned off.

- Use Energy-Efficient Appliances: When replacing appliances, choose energy-efficient models that are Energy Star certified.

Pro-Tip: Take advantage of rebates and incentives offered by your utility company for energy-efficient upgrades.

Also, utility rate optimization may also yield savings.

10. Practice the Art of Delayed Gratification: Mastering Your Money Mindset

Delayed gratification is the ability to resist the temptation of immediate pleasure in favor of a greater reward in the future.

This is crucial for financial success.

How to Delay Gratification:

- Set Financial Goals: Having clear financial goals can help you resist the temptation of immediate gratification.

- Visualize Your Future: Visualize the future you want to create and how your financial goals will help you achieve it.

- Remind Yourself of Your Priorities: Remind yourself of your priorities and the things that are most important to you.

- Find Alternative Rewards: Find alternative rewards that don’t involve spending money, such as spending time with loved ones, exercising, or pursuing a hobby.

Pro-Tip: Start small and gradually increase the length of time you delay gratification.

This will help you build the discipline needed for long-term financial success.

Conclusion

These 10 financial life hacks are not a magic bullet, but they are powerful tools that can help you take control of your finances and build a secure financial future.

The key is to implement these hacks consistently and make them a part of your daily routine.

A 30-day financial challenge can help you achieve this.

Remember, financial success is not about getting rich quick; it’s about making smart choices, developing good habits, and being patient.

By adopting these financial life hacks, you’ll be well on your way to achieving your financial goals and living the life you’ve always dreamed of.

So, start today, and watch your financial future transform!