Disclaimer: This post may contain affiliate links, meaning we get a small commission if you make a purchase through our link at no extra cost to you. For more information, please visit our Disclaimer Page.

Managing your money can be a real challenge. Between bills, unexpected expenses, and saving for the future, it’s easy to feel overwhelmed.

A budget can help you take control, but creating one from scratch can be daunting. That’s why we’ve created a simple solution to help you get started.

It helps you visualize where your money is going and identify areas to cut back. With this tool, you can finally make progress toward your financial goals.

Why use a monthly budget planner?

“Money is a tool that creates freedom when you know how to use it right.”

Nobody wants to feel stressed about money. A budget planner helps you:

- Track where every dollar goes.

- Reduce financial stress.

- Meet your savings goals.

- Plan for big purchases.

- Build your emergency fund.

Free monthly budget planner Excel spreadsheet

Bi-weekly budget planning Excel template

“Small steps in the right direction can turn into miles of progress.”

Ready to start tracking your money? I’ve created a simple but effective Excel spreadsheet you can download right now. This template includes:

- Monthly income tracker.

- Expense categories.

- Savings goals.

- Debt payoff planning.

- Auto-calculating formulas.

To use the spreadsheet effectively:

- Input your monthly income.

- List all regular expenses.

- Set realistic savings goals.

- Track spending daily.

- Review and adjust.

Download the free bi-weekly budget planner Excel template here.

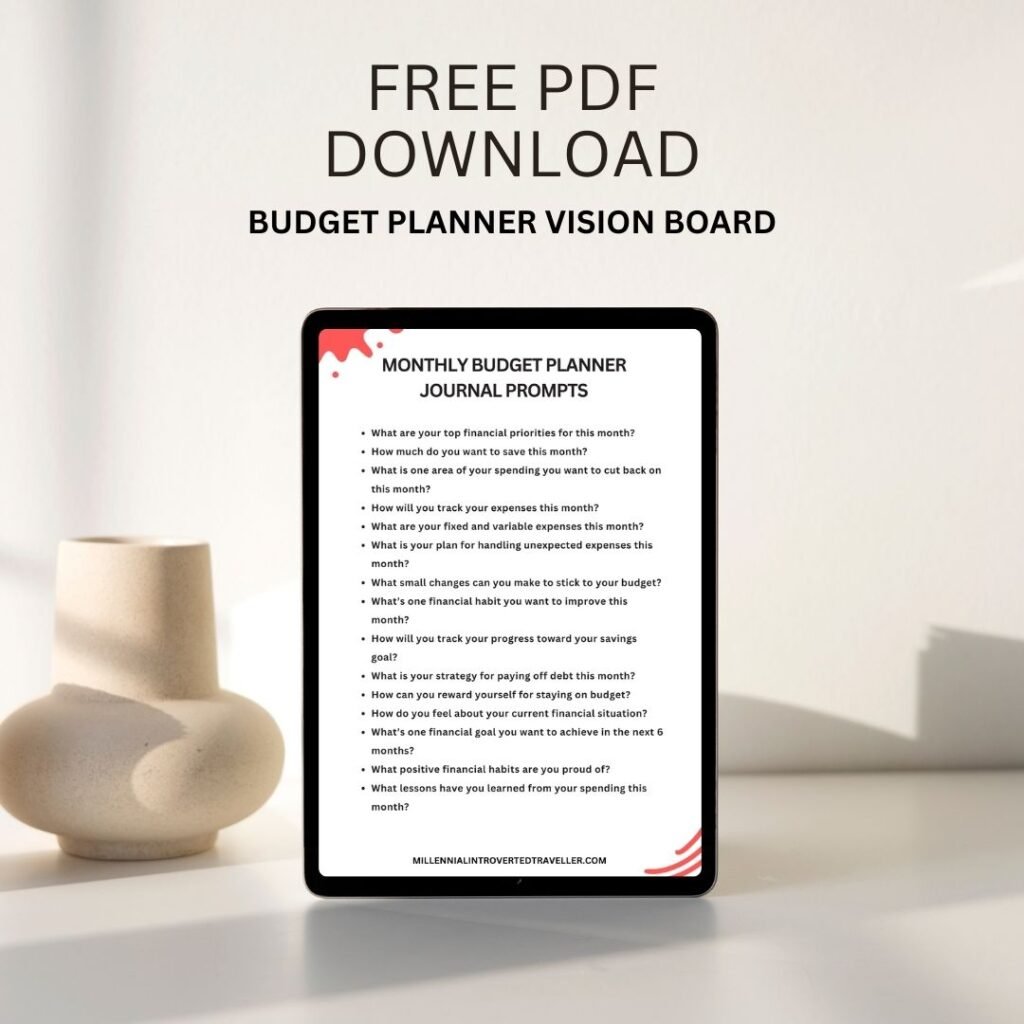

Budget planner journal prompts: A hands-on approach to budgeting

“Financial freedom starts with knowing your numbers.”

“Writing down your spending creates awareness that digital tools can’t match.”

Benefits of using a physical journal:

- More mindful spending

- Better connection with your money

- Satisfaction of writing things down

- No technology required

- Perfect for visual learners

Our free monthly budget planner journal prompts provide a simple, yet powerful way to take control of your money. By spending just a few minutes each day reflecting on these prompts, you can:

- Gain clarity on your spending habits.

- Identify areas where you can save.

- Set and achieve your financial goals.

- Reduce financial stress and anxiety.

Ready to transform your relationship with money?

Download our free monthly budget planner journal prompts and start building a brighter financial future today!

Best free monthly budget planner apps for 2025

“Technology should make managing money easier, not harder.”

Below are the top recommended apps to streamline your budgeting in 2025:

1. Mint

Overview: Mint is one of the most popular free budgeting apps. It automatically tracks expenses, categorizes spending, and offers bill tracking and credit score monitoring.

Features:

- Syncs with bank accounts, credit cards, and bills.

- Tracks spending by category.

- Creates budget goals and alerts.

- Provides credit score tracking.

Platform: iOS, Android, Web.

2. PocketGuard

Overview: PocketGuard shows your disposable income after bills and savings goals, ideal for users who prefer a simple budgeting plan.

Features:

- Tracks income, bills, and subscriptions.

- Displays spendable income after expenses.

- Sends alerts for overspending.

Platform: iOS, Android.

3. EveryDollar

Overview: Created by Dave Ramsey, EveryDollar uses zero-based budgeting to assign every dollar a purpose. The free version requires manual entry.

Features:

- Zero-based budgeting method.

- Easy-to-use interface.

- Budget tracking and expense categorization.

Platform: iOS, Android, Web.

4. GoodBudget

Overview: GoodBudget uses the envelope method, letting you allocate funds to virtual spending categories. Great for couples or shared budgets.

Features:

- Envelope budgeting system.

- Tracks spending and savings goals.

- Syncs across devices for shared budgets.

Platform: iOS, Android, Web.

5. YNAB (You Need A Budget)

Overview: YNAB focuses on “giving every dollar a job.” While not free, it offers a 34-day free trial and tools to improve financial habits.

Features:

- Zero-based budgeting.

- Real-time account syncing.

- Educational resources for financial control.

Platform: iOS, Android, Web.

6. Spendee

Overview: Spendee offers a visually appealing interface for tracking expenses and creating budgets, with multi-currency support (premium feature).

Features:

- Budget creation and expense tracking.

- Bank syncing (premium).

- Multi-currency budgeting.

Platform: iOS, Android, Web.

These apps cater to diverse budgeting styles, from automatic syncing to hands-on envelope systems. Choose the one that aligns with your financial goals and habits.

Budget planner vision board

Dream it, achieve it! Visualize your financial success with our free budgeting vision board guide.

Creating a vision board is a powerful way to clarify and achieve your financial goals. Our free guide offers prompts and inspiration to:

- Clarify your financial priorities. What does financial freedom mean to you?

- Set actionable steps. How will you work toward your goals?

- Stay motivated. Display your vision board in a visible location to maintain daily focus.

Ready to turn your financial goals into reality?

Download our free budgeting vision board guide and start planning your success today!

Tips for effective budget planning

Setting financial goals

“Your financial goals are the blueprint for your future.”

SMART goal-setting tips:

- Start with your biggest dreams.

- Break them into smaller milestones.

- Set specific dollar amounts.

- Choose realistic timeframes.

- Track progress monthly.

Tracking your spending

“What gets measured gets managed.”

Essential tracking habits:

- Keep all receipts.

- Log expenses daily.

- Review bank statements weekly.

- Categorize all spending.

- Note patterns and trends.

Identifying areas to save

“Saving money doesn’t mean living less—it means living smart.”

Quick ways to save:

- Review subscriptions monthly.

- Plan meals before shopping.

- Use cash for problem-spending areas.

- Wait 24 hours before big purchases.

- Look for better rates on bills.

Making your budget work in real life

Dealing with variable income

“Irregular income requires flexible planning.”

Tips for variable income:

- Base your budget on the lowest monthly income.

- Save extra during good months.

- Build a larger emergency fund.

- Plan essential expenses first.

- Use percentages instead of fixed amounts.

Handling unexpected expenses

“Preparation turns surprises into minor inconveniences.”

Be ready for surprises:

- Build an emergency fund first.

- Review insurance coverage.

- Keep some budget flexibility.

- Plan for irregular expenses.

- Learn basic home or car maintenance.

Staying motivated

“Financial success is a marathon, not a sprint.”

Motivation strategies:

- Celebrate small wins.

- Track progress visually.

- Share goals with an accountability partner.

- Reward yourself within your budget.

- Focus on long-term benefits.

Common budgeting mistakes to avoid

“Learn from others to save yourself time and money.”

Watch out for:

- Setting unrealistic goals.

- Forgetting irregular expenses.

- Not adjusting for life changes.

- Ignoring small purchases.

- Making it too complicated.

Tools for success

“The right tools make any job easier.”

Essential budgeting tools:

- Calculator.

- Expense-tracking app.

- Bill payment calendar.

- Receipt organization system.

- Regular money check-ins.

Making your budget stick

“Consistency beats perfection every time.”

Tips for long-term success:

- Review weekly.

- Adjust monthly.

- Plan for fun.

- Keep it simple.

- Stay flexible.

Wrapping things up

Budgeting doesn’t have to be a chore.

With our free monthly budget planner template, you’ll gain clarity on your finances and make informed spending decisions.

Remember: A budget is a living document. Review it regularly, adjust as needed, and experiment with strategies to find what works best.

Download the free monthly budget planner template for 2025 today and start your journey toward financial wellness!